Atr Forex Indicateur Forex Pullback System

Listed as "Average True Range," ATR is on the Indicators drop-down menu. The "parameters" box to the right of the indicator contains the default value, 14, for the number of periods used to smooth the data. To adjust the period setting, highlight the default value and enter a new setting. In his work, Wilder often used an 8-period ATR.

How to Use the Average True Range Indicator (ATR) 📈 YouTube

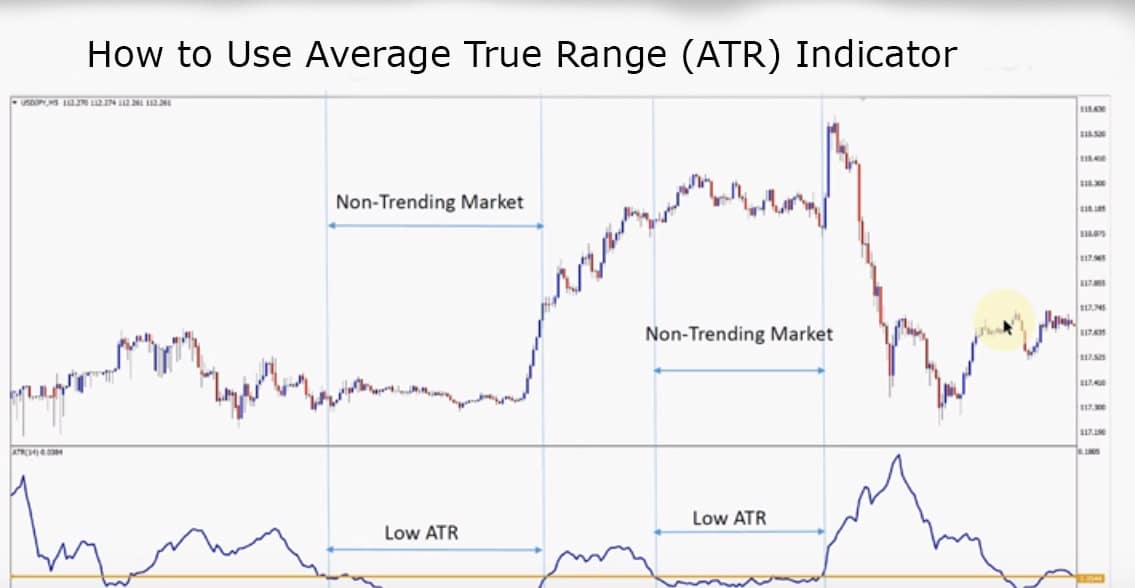

The basics. Average True Range is a continuously plotted line usually kept below the main price chart window. The way to interpret the Average True Range is that the higher the ATR value, then the higher the level of volatility. The look back period to use for the ATR is at the trader's discretion however 14 days is the most common.

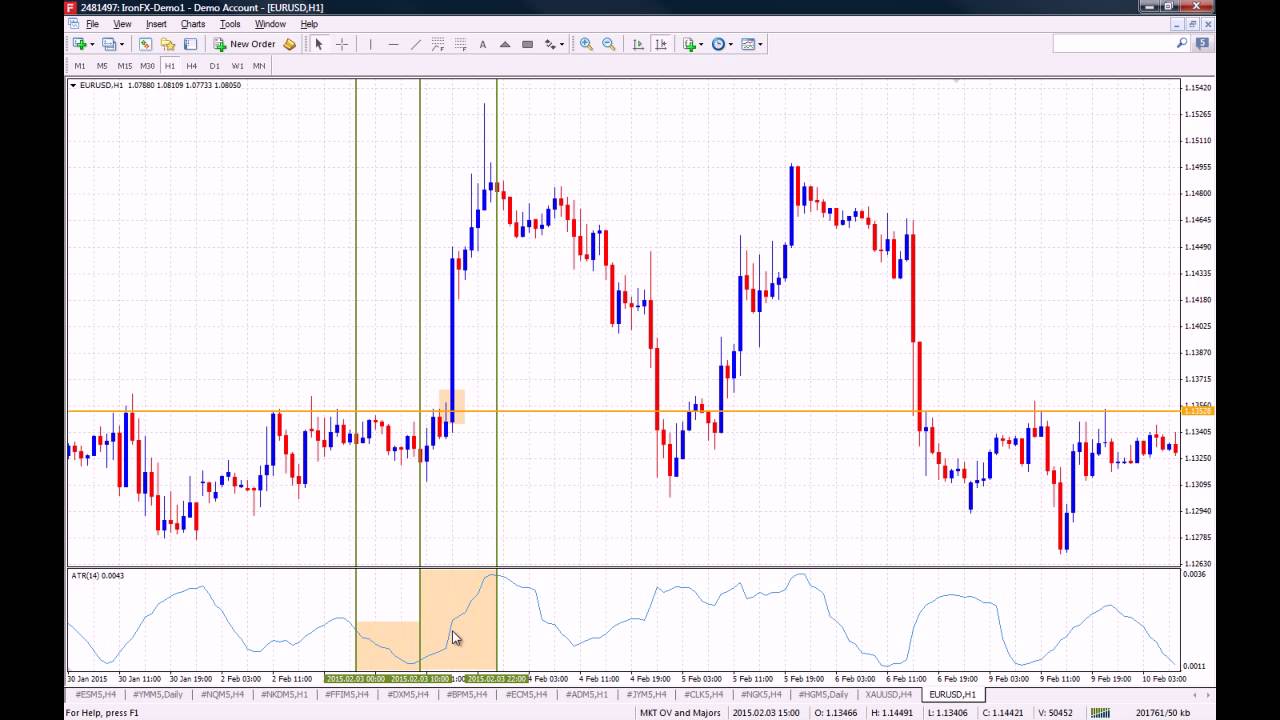

How to use Average True Range technical indicator on MT4 and MT5

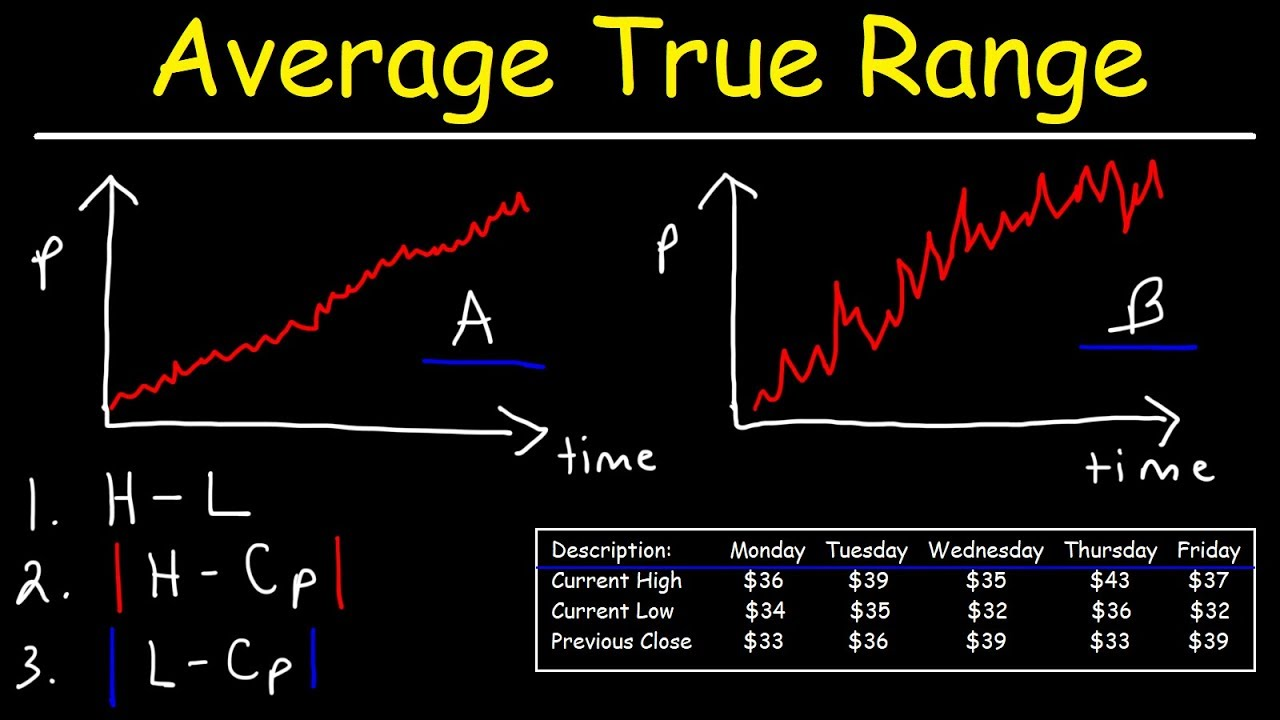

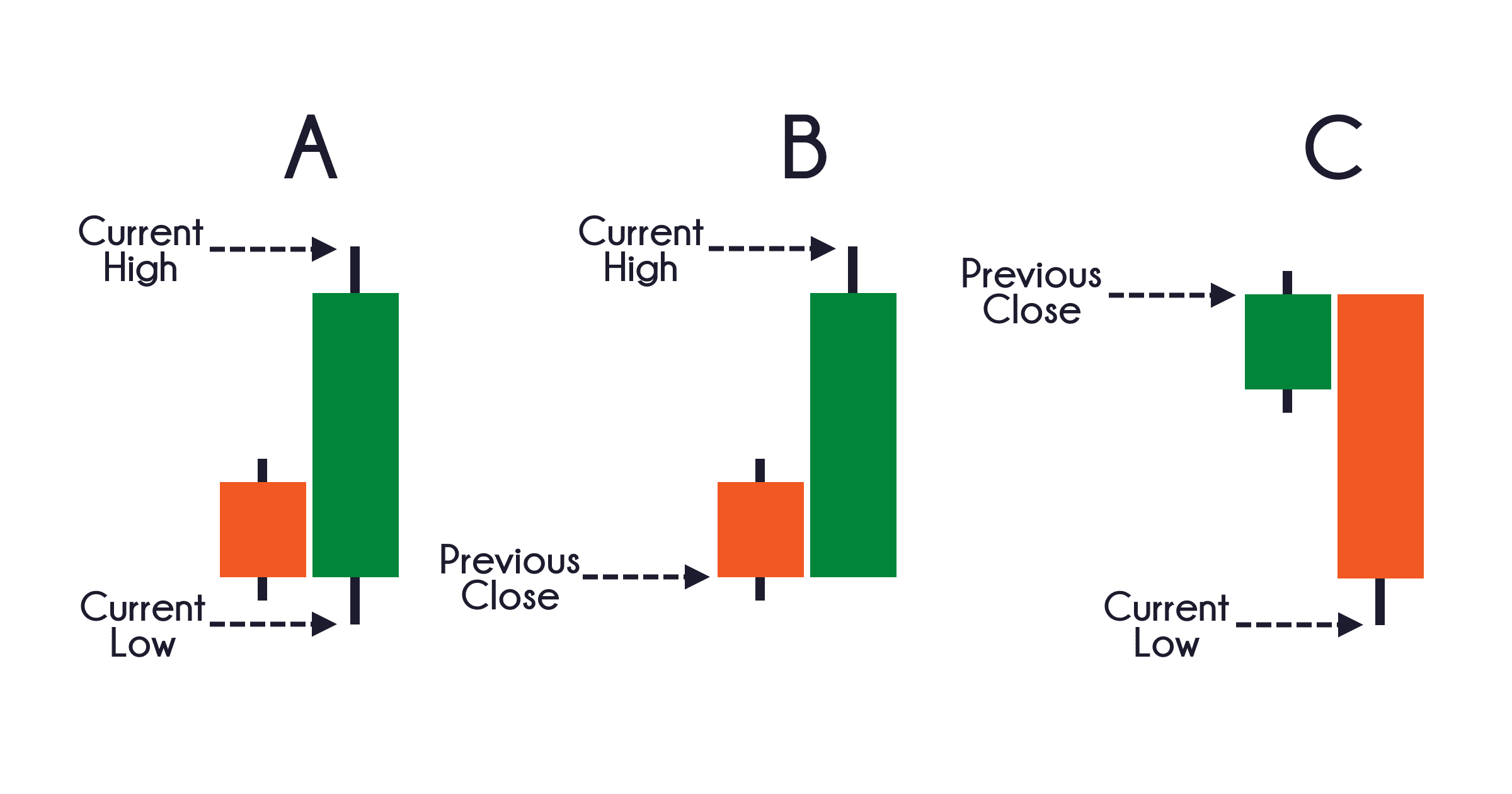

You can use these three methods to determine the true range of candlesticks: 1) Subtract the current low from the current high. 2) Take the current high and subtract the previous close. 3) Subtract the previous close from the current low. Methods two and three account for gaps and inside days in price action.

Average True Range indicator for MetaTrader4 (MT4) free download

The Average True Range (ATR) is a market volatility indicator used in trading. Calculated from the 14-day simple moving average of price ranges, it measures asset price variation over time. A higher ATR suggests increased volatility, aiding traders in setting stop-loss levels and assessing potential market movements.

Average True Range Indicator for MT4 Download Free

Summary. The average true range is an indicator of the price volatility of assets over a specific period. Average true range values are generally calculated based on 14 periods. The period can be monthly, weekly, daily, or even intraday. A high value of average true range implies high volatility of the market price of the assets and a low value.

Average True Range Indicator in Forex Trading Forex Traders Guide

Reviewed by. Michael J Boyle. Fact checked by Hilarey Gould. Photo: Morsa Images / Getty Images. The average true range (ATR) indicator measures market volatility and can be helpful to investors when trading. Learn how it works so you can make smart stock trades.

What Is Average True Range? InoSocial

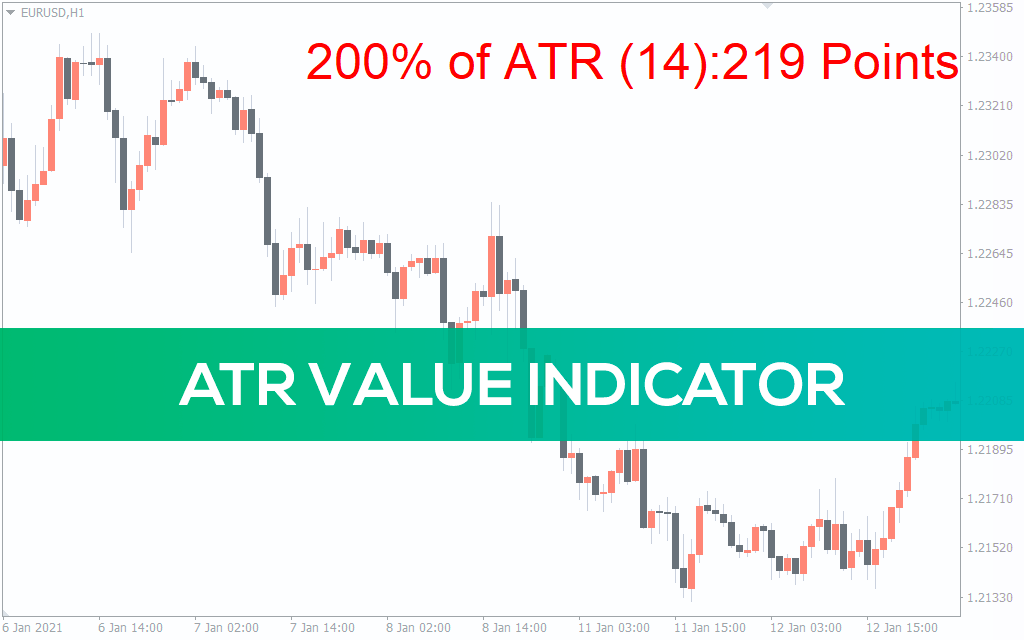

ATR stands for Average True Range which means that the ATR measures how much the price moves on average. In essence, the ATR measures the candle size and the range of price movements. Below I set the ATR to 1 period which means that the ATR just measures the range/size of one candlestick. The relationship between the candle size and the ATR.

How to use Average True Range Indicator YouTube

The average true range (ATR) indicator is one of a number of popular trading indicators, and it is used to track volatility in a given time period. It moves up or down according to whether an asset's price movements are becoming more or less dramatic - with a higher ATR value representing greater volatility in the underlying market, and a.

The True Benefits of the ATR Indicator Forex Academy

The average true range (ATR) is a technical analysis indicator that measures market volatility and shows how much a security's price moves, on average,. To use the ATR indicator for setting a stop loss, first determine the ATR value over a chosen period (e.g., 14 days). Then, set your stop loss at a multiple of the ATR below the current or.

Free Download

Average True Range ( ATR) is a technical analysis indicator that measures price volatility of a financial security over a period of time, typically 14 days. ATR is calculated as the average of the true ranges over the period. It's a measure of volatility, not a directional indicator. A higher ATR signals more volatility, and vice versa.

How to read and use average true range trading indicator

For example, a stock might fluctuate on average $2 per day, but the range of a day, week, or month typically exceeds that. Because there can be a fair amount of volatility with true range, the indicator looks at the average of the true range to help smooth things out. Calculate Your Exit Point. So, how do you apply ATR? First, set your parameters.

How to Use Average True Range (ATR) Indicator in Your Forex Trading

Description. Average True Range (ATR) is the average of true ranges over the specified period. ATR measures volatility, taking into account any gaps in the price movement. Typically, the ATR calculation is based on 14 periods, which can be intraday, daily, weekly, or monthly. To measure recent volatility, use a shorter average, such as 2 to 10.

Average True Range Indicator Explained Simply In 3 Minutes YouTube

Average True Range - ATR: The average true range (ATR) is a measure of volatility introduced by Welles Wilder in his book, "New Concepts in Technical Trading Systems." The true range indicator is.

How to use Average True Range Indicator? YouTube

The Average True Range (ATR) is an indicator that measures the volatility of the market. You can use the ATR indicator to identify multi-year low volatility because it can lead to explosive breakout trades. You can set your stop loss 1 ATR away from Support & Resistance so you don't get stopped out prematurely.

Average True Range Indicator Using It Profitably

In the Apple example above you would take the ATR value of .29 and then apply for example a 3x multiplier for your target and 1x for your average true range stop. This would provide you a target price of (.29 *3) + $126.47 = $127.34. Conversely, the average true range stop loss for this trade would be $125.60.

Average True Range (ATR) How to Calculate and Use It Timothy Sykes

The Average True Range (ATR) is a common technical analysis indicator designed to measure volatility. This indicator was originally developed by the famed commodity trader, developer and analyst, Welles Wilder, and it was introduced in 1978. The ATR was intended to provide a qualitative approach that would assign a numerical figure to the.

.